|

|

Nvidia Is Taking Trump’s ‘Stargate’ Idea Global. Should You Buy NVDA Stock Now?/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)

Celebrated Wedbush tech analyst Dan Ives refers to Nvidia (NVDA) CEO Jensen Huang as “90% CEO" and “10% politician.” It seems that there is some truth to it after all. After negotiating a deal with the White House to reverse the previous ban on the sale of the company’s H20 chips to China, Nvidia has revealed that it will invest a mammoth 11 billion British pounds in the United Kingdom to develop the country’s AI infrastructure and deepen its presence in the country. This coincides with President Donald Trump’s state visit, marking his first trip across the pond after a historic trade deal with the U.K. Nvidia Will Help Boost British AI AmbitionsAimed toward bolstering the U.K.’s AI infrastructure, Nvidia, along with the British AI company Nscale and its long-term partner CoreWeave (CRWV), plans to invest up to 11 billion pounds in U.K.-based AI factories. This ambitious project, which will deploy up to 120,000 Blackwell GPUs, represents the largest AI infrastructure rollout in the country’s history. This initiative extends beyond the U.K., with Nvidia and Nscale also set to scale up 300,000 Nvidia Grace Blackwell GPUs in AI factories across the U.S., Portugal, and Norway. The U.K. portion of this deployment is slated to receive up to 60,000 GPUs. Notably, this infrastructure will support OpenAI’s “Stargate UK” initiative, which aims to establish “sovereign compute” capabilities in the U.K. This means that AI models, including advanced reasoning models like GPT-5, will be able to run on hardware located in the U.K. and be subject to its jurisdiction, which is particularly crucial for sensitive and regulated applications. Notably, while Nvidia has had a commercial presence in the U.K. for decades, it has amped up its number of strategic programs in the island nation by quite a bit in recent years. Perhaps the most noteworthy among them occurred when Nvidia announced and funded Cambridge-1, touted to be the U.K.’s most powerful supercomputer. Aimed at AI research in healthcare and life sciences, Cambridge-1 was launched in mid-2021 with founding partners that included British pharma giants such as AstraZeneca (AZN), GlaxoSmithKline (GSK), National Health Service trusts, and academic institutions to support medical imaging, genomics, and drug discovery. Thus, having established partnerships in the Middle East and with increasing presence in the U.K. and the Europe Union, Nvidia’s sovereign AI is slowly but steadily becoming a vital part of its business empire. But the world’s most valuable company, with a market cap of $4.1 trillion, whose stock has risen by 31.2% on a YTD basis, has its opponents. Chief among them are those who highlight the stock’s expensive valuation. However, is that reason enough to pass on NVDA stock? Not at all, and here's why.

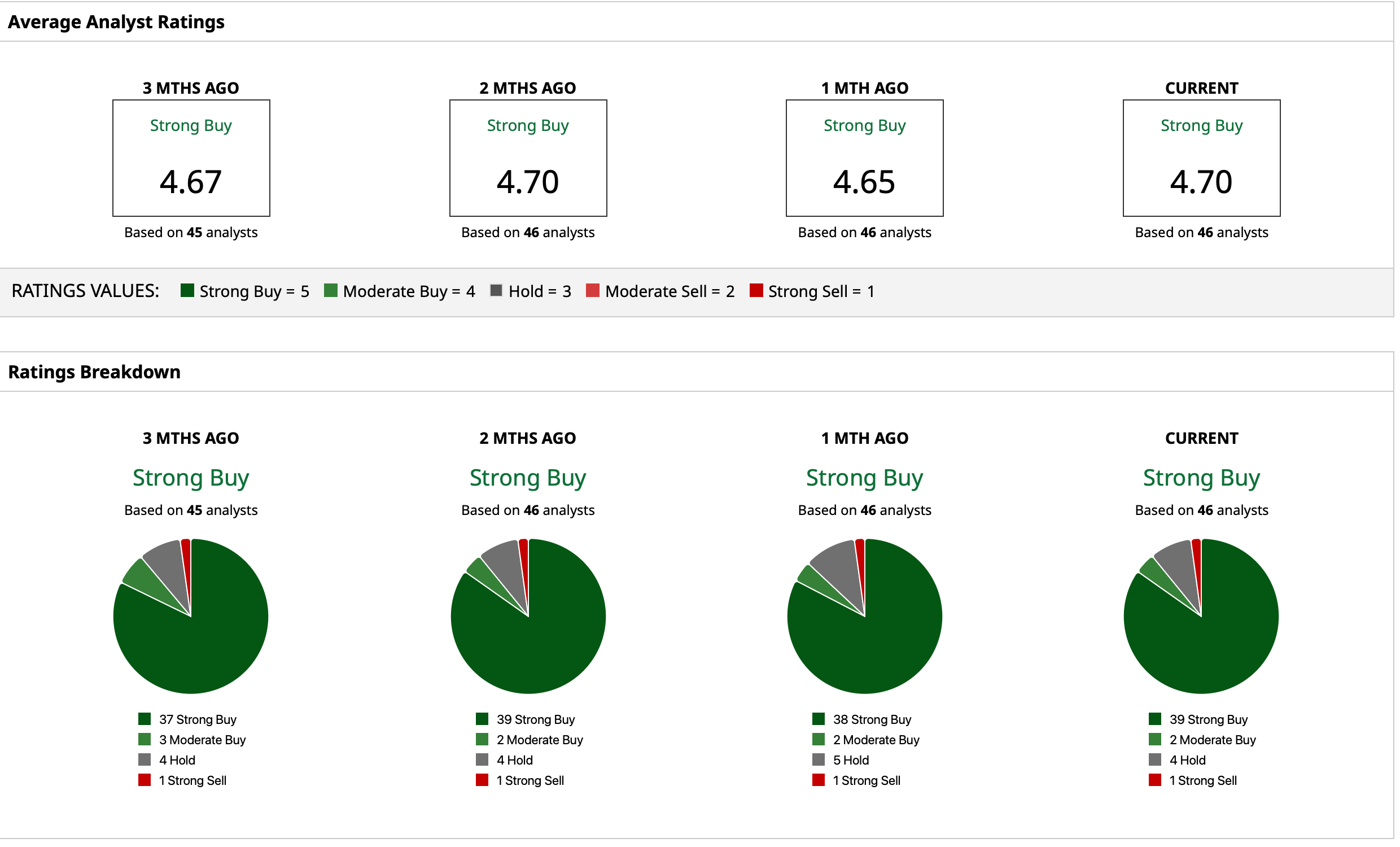

Nvidia Has Solid FinancialsWhile skeptics may point toward Nvidia’s seemingly rich valuations, a key metric that takes into account the superlative growth of the company gives a much more accurate picture The forward PEG ratio, or the ratio of the company’s price-earnings ratio to its growth rate, stands at 1.06x. This is lower than the sector median of 1.86x. This means that Nvidia stock is still valued cheaper than the underlying industry when its projected growth rate is taken into account. And speaking of growth, Nvidia’s track record speaks for itself. The past 10 years have seen the company’s revenue and earnings clock scarcely believable compound annual growth rates (CAGRs) of 42.52% and 66.59%, respectively. Moreover, analysts are expecting the forward revenue and earnings growth rates for Nvidia to be 64.99% and 72.13%, much ahead of the sector medians of 7.58% and 11.17%, respectively. Plus, Nvidia outperformed expectations in its latest quarter, reporting $46.7 billion in revenue, a 56% increase year-over-year. Earnings per share (EPS) reached $1.05, surpassing the consensus estimate of $1.01 and marking a 54% YOY gain. The data center division continued to be the main growth driver, generating $41.1 billion in revenue, which was a 5% sequential increase and a 56% YOY surge. Looking ahead, Nvidia forecasts next-quarter revenues to be near $54 billion, plus or minus 2%, aligning closely with Wall Street’s forecast of $53.14 billion. AI Is Driving the ShowNvidia’s financial strength stems from its superior product, which has made it an undisputed leader in the GPU market with a 92% share. And it looks like that is set to continue. Nvidia’s strategic vision extends well into the future, with its product roadmap featuring the Blackwell, Rubin, and Feynman architectures. A key highlight is the Blackwell Ultra, which demonstrates a significant leap in performance for large-scale AI. It achieves up to a 45% increase in inference throughput on the DeepSeek-R1 reasoning benchmark compared to existing Blackwell systems. On a per-GPU basis, this represents an approximate fivefold increase in throughput over the prior-generation Hopper architecture, directly translating into lower operational costs and higher productivity for clients developing and deploying advanced AI models. Building on this momentum, the Rubin architecture, featuring the specialized Rubin CPX GPU, targets the next frontier in AI: massive-context inference. The Rubin CPX is specifically designed to accelerate the compute-intensive context phase of million-token workloads, such as those used in advanced software and video generation. The integrated Vera Rubin NVL144 CPX platform is anticipated to deliver 8 exaflops of AI performance, marking a 7.5x increase over the GB300 NVL72, with 100 terabytes of fast memory in a single rack. On the software front, CUDA remains a pivotal component of its ecosystem. With a growing community of over 6 million developers, the adoption of CUDA is accelerating, evidenced by a more than 100% jump in downloads from 26 million in 2021 to 53 million in 2024. Analyst Opinions on NVDA StockConsidering this, analysts have deemed NVDA stock a “Strong Buy,” with a mean target price of $211.42. This indicates upside potential of about 20% from current levels. Out of 46 analysts covering the stock, 39 have a “Strong Buy” rating, two have a “Moderate Buy” rating, four have a “Hold” rating, and one has a “Strong Sell” rating.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|