|

|

Will Ethereum Continue to Rise to New Highs?

I highlighted the rally in Ethereum that took the cryptocurrency to a new all-time high in my August Barchart recap on the price action in commodities. Ethereum posted a 16.45% gain in August, closing the month at $4,345.331 after rising to a new record high of $4,953.929 per token. I late September, Ethereum was marginally higher than the August closing level, but the bullish trend remains firmly intact. Ethereum is the second-leading cryptocurrencyEthereum and Bitcoin dominate the cryptocurrency asset class.

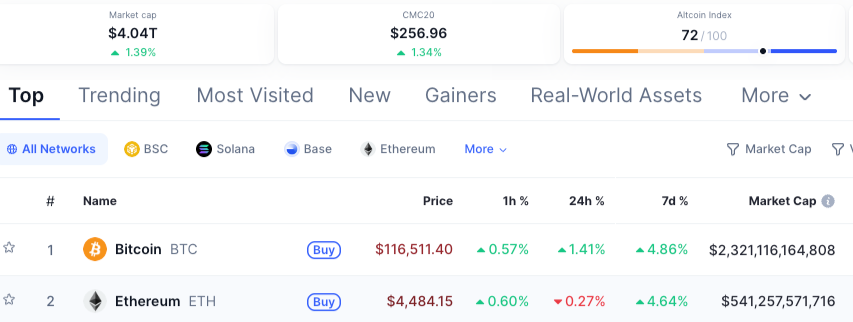

The chart highlights Bitcoin’s $2.321 trillion cap and Ethereum’s $541.258 market cap. The combined $2.862 trillion is over 70.8% of the entire cryptocurrency asset class’s $4.04 trillion value. While Bitcoin is worth over four times more than Ethereum, Ethereum is worth nearly three times more than third-place Tether, a stablecoin tied to the U.S. dollar. The difference between Bitcoin and EthereumThe primary difference between the two leading cryptocurrencies is that while Bitcoin is designed to provide an alternative to physical or fiat currency, Ethereum is intended for complex smart contracts and decentralized applications. Ethereum’s design is crucial for the emerging and theoretical infrastructure of the future of the internet, also known as Web3. Web3 is the next iteration of the internet, utilizing blockchain technology to establish a decentralized ecosystem that empowers users with greater control and ownership of their data and digital assets, rather than relying on large corporations. Bitcoin and Ethereum are complementary, not competitors. Bitcoin is akin to digital gold, due to its scarcity and durability. Bitcoin is a means of exchange that employs a “Proof-of-Work” consensus algorithm to broadcast, store, and confirm transactions. Ethereum is more than just a digital asset; it is a decentralized platform enabling the development and execution of smart contracts and other decentralized applications. Ethereum is transitioning to a “Proof-of-Stake” blockchain consensus mechanism, where network participants, or validators, are chosen to create new blocks and validate transactions based on the amount of cryptocurrency they “stake” or lock up as collateral. One of the leading differences between “Proof-of-Work” and “Proof-of-Stake” is that the former uses vast amounts of computational power and energy for mining, while the latter relies on staked tokens to secure the network, promote honest participation, and provide an incentive for participants to act in the network’s best interest as they risk losing their stake for malicious actions. Expect lots of volatilityThe monthly charts highlight the massive price swings in Bitcoin and Ethereum over the past years.

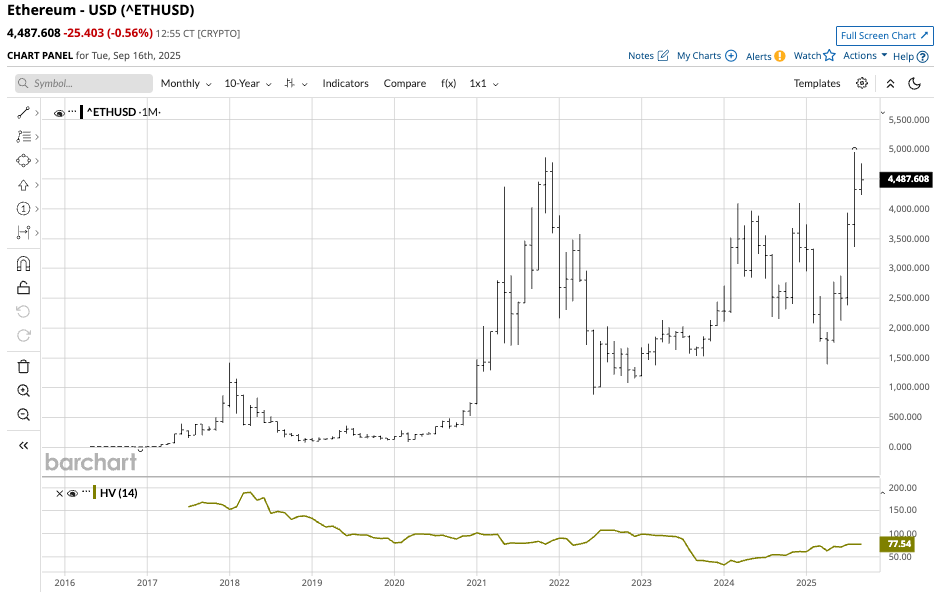

While Bitcoin has been in a bullish trend, the ten-year monthly chart highlights the massive price swings, with historical volatility of 41.66%.

Ethereum’s monthly chart shows that the second-leading cryptocurrency has experienced even more price variance with a historical volatility reading at 77.54%. The case for higher EthereumThe bullish case for Ethereum includes:

While there are many factors that support Ethereum, and a continuation of higher highs, volatility over the past years is a significant reason for caution, as periodic violent price corrections remain likely. The reasons why buyers must be cautiousEthereum, Bitcoin, and all cryptocurrencies are highly volatile assets. The fantastic returns over the past years have not been in a straight line, as substantial percentage declines have occurred. Therefore, anyone dipping a toe into the cryptocurrency asset class must understand, embrace, and expect continued massive price swings. Since Bitcoin burst onto the scene in 2010, the leader, Ethereum, and the thousands of other cryptocurrencies have continued to make higher highs. However, buying during price weakness has been optimal as buying new highs has led to more than a bit of indigestion during the many downdrafts that have shaken the confidence of even the most dedicated cryptocurrency supporters. While the number of proponents is growing with increased market access, there are many opponents who continue to doubt the asset class’s intrinsic value. Moreover, cryptocurrencies are global assets that threaten the government’s ability to control the money supply, which could be one of the leading issues facing the asset class over the coming years. Bitcoin, Ethereum, and the numerous other stablecoins and cryptocurrencies continue to attract an increasing number of investors, as financial institutions are allowing their customers to allocate a percentage of their portfolios to this asset class. Moreover, at $3.81 trillion, the asset class remains smaller than NVDA’s market cap, which stands at over $4 trillion. Therefore, cryptos have room to grow, but the potential comes with commensurate risks. Ethereum’s role as a critical application in Web3 supports owning the second-largest cryptocurrency, but as history has shown, buying on dips has been optimal, and that is likely to be the case. On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|