|

|

These Stocks Benefit From a Fed Rate Cut, Including 1 Surprise Buy Yielding Nearly 3%

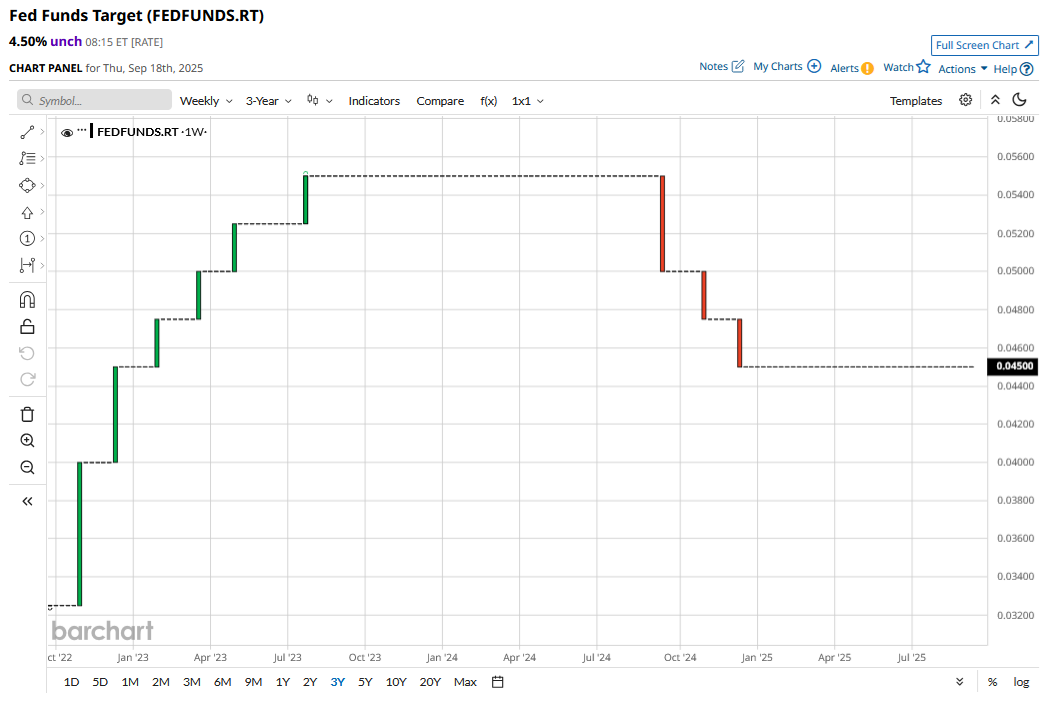

As widely expected, the Federal Reserve lowered rates by 25 basis points yesterday, Sept. 17. It was the first rate cut by the U.S. central bank in 2025, and the so-called dot plot called for another 50-basis-point rate cut this year. Notably, the rate cut came at a time when inflation is still running above the Fed’s 2% target. The Fed maintained its 2025 core Personal Consumption Expenditures (PCE) inflation projection at 3.1% while raising the 2026 forecast from 2.4% to 2.6%. The Fed also raised its 2027 inflation projection and does not expect its preferred PCE metric to fall to 2% that year either.  The Fed Is Getting Worried About the Labor MarketOn the positive side, it also raised its growth forecast and now expects the U.S. economy to expand by 1.6% in 2025 and 1.8% in 2026, both of which are 20 basis points higher than the previous forecast. That said, the Fed is now increasingly worried about the economy and labor market conditions, and its statement read, “The Committee is attentive to the risks to both sides of its dual mandate and judges that downside risks to employment have risen.” Powell termed the rate cut a “risk-management cut” while adding, “What’s different now is that you see a very different picture of the risks to the labor market.” Notably, the Fed is currently grappling with a central bank’s worst dilemma, having to address a weakening labor market at a time when inflation remains quite sticky. Both these are conflicting demands, as while the rate cut should help support the economy, it might spur inflation. What Stocks to Buy After Fed Rate CutRate cuts are a positive for most industries. For instance, interest-sensitive sectors like automotive and housing stand to gain, as lower interest rates can help buoy demand. However, the housing market is currently challenged, and the Fed rate cut won’t move the needle much as it was already priced in. As for the auto sector, there is still a lot of uncertainty over tariffs, which would keep a lid on any upside in names like Ford (F) and General Motors (GM). Rate cuts are also positive for consumer discretionary companies, retailers, and e-commerce companies like Amazon (AMZN), as they can spur buying. Companies with a significant debt burden also stand to benefit from lower rates, as their interest expenses decrease, thereby boosting profitability. Lower rates are also positive for buy-now-pay-later (BNPL) companies like Affirm (AFRM), as it lowers their borrowing costs. Growth stocks whose future cash flows become more valuable in today’s dollar terms with rate cuts are also a play on Fed rate cuts. Stocks with high dividend yields also see buying interest as yields on fixed income fall. The list includes utility plays like Brookfield Renewable Partners LP (BEP), which boasts a dividend yield north of 6%. Then we have gold mining companies, which are enjoying a rally of a lifetime thanks to the surge in gold prices. Lower interest rates are theoretically positive for gold, which is a non-interest-bearing asset and therefore loses out to interest-bearing assets in periods of high interest rates. In the gold mining space, Agnico Eagle Mines (AEM) is one of the safest bets given its portfolio of low-cost mining assets in safe jurisdictions.  Fed rate cuts are also generally positive for emerging market equities, as some of the cheap money has tended to chase higher returns in global stocks. This especially holds in the current scenario, where valuations of U.S. stocks are running well ahead of historical averages while some international markets are looking attractive. International Stocks Could Also Benefit from Fed Rate CutInternational stocks rallied today after the Fed rate cut. I believe one of the ways to play the Fed rate cut is through global stocks, and I find Indian information technology (IT) stocks a good place to hide. One such example would be Infosys (INFY), which recently announced a $2 billion buyback—the largest for any Indian IT company—as a good bet. The sector, which gets the bulk of its revenues from the U.S., has been marred by the heightened trade tensions between the two countries. However, the relations between the two countries should eventually get back on track. While the company, like fellow Indian IT companies, faces some serious headwinds from artificial intelligence (AI), the near-term risk-reward looks attractive. The Indian rupee has weakened against the greenback and is hovering near record lows, creating a near-term tailwind for names like Infosys. INFY looks reasonably priced at a forward price-to-earnings (P/E) multiple of 21.4x and brings a dividend yield of 2.86% to the table. While it might not be the first name that comes to mind when thinking about buying stocks that benefit from the Fed's rate cut, the company is a proxy play on the U.S. economy and interest rates. On the date of publication, Mohit Oberoi had a position in: AFRM , F , GM , AMZN , INFY . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|