|

|

1 Magnificent Stock Under $500 to Buy and Hold Forever/Oracle%20Corp_%20logo%20on%20phone-by%20WonderPix%20via%20Shutterstock.jpg)

For investors looking for a company prepared for a multi-year artificial intelligence (AI) megatrend while still returning capital to shareholders, Oracle (ORCL) might just be the right choice. The company has positioned itself as a full-stack, enterprise-data and AI cloud provider, with a huge backlog of contracted future revenue, rapidly growing cloud consumption, and an active return-of-capital program. Oracle's first-quarter fiscal 2026 results delighted investors and analysts, pushing the stock up nearly 80% year-to-date (YTD).

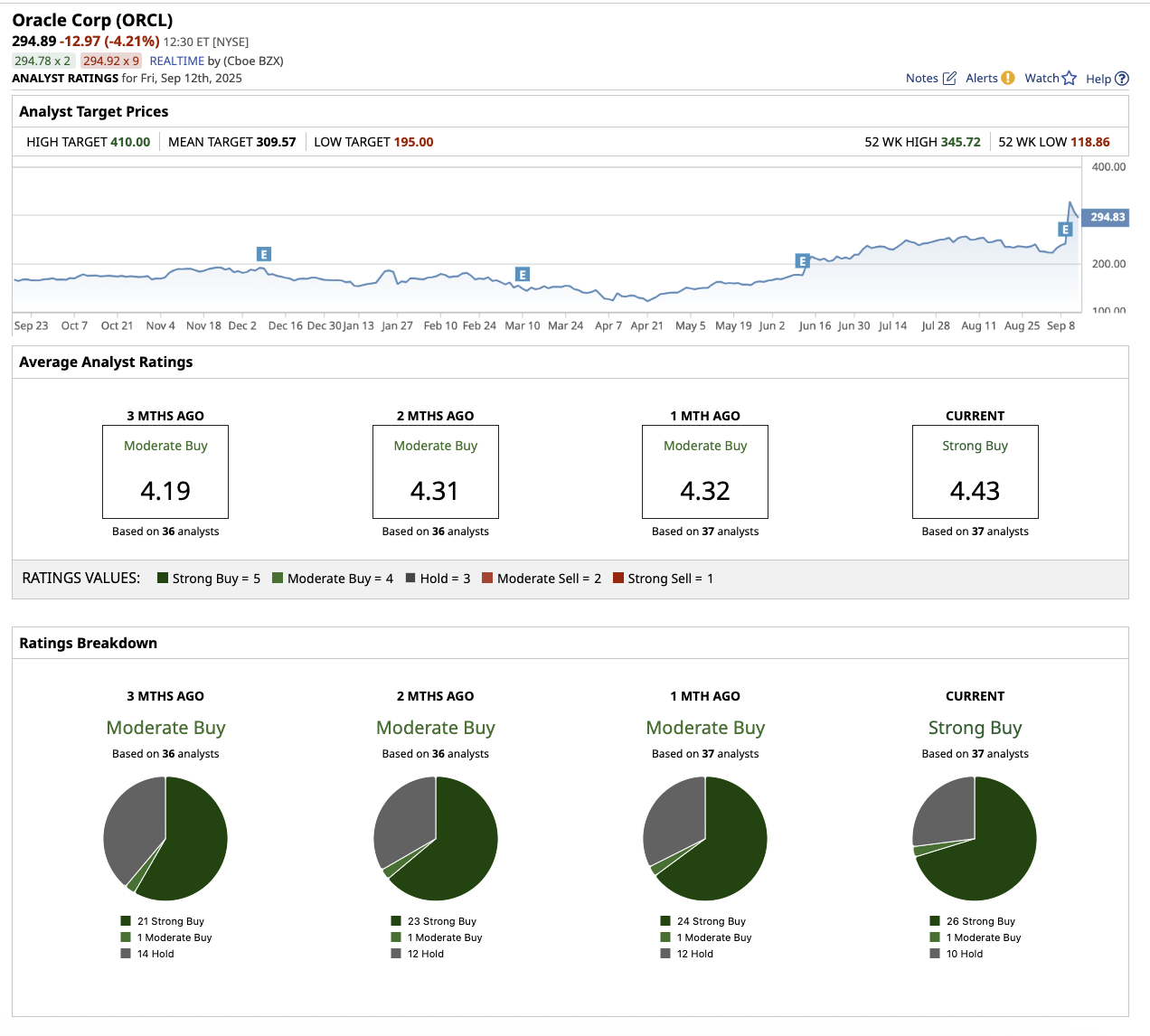

AI Demand Is SoaringFounded in 1977, Oracle is a global technology company best known for its enterprise software, cloud services, and database technologies. Oracle integrates AI, machine learning, and advanced analytics into its products to help businesses automate processes and make more informed decisions. Oracle's management claims that the company has become "the go-to place for AI workloads." The most noteworthy aspect of the first quarter was the eye-catching 359% year-over-year (YoY) growth in remaining performance obligations (RPO) of $455 billion, which was driven by four multibillion-dollar contracts signed with three distinct clients during the quarter. This reflects a significant contract backlog for future revenue. The company also saw strong momentum in cloud, where demand continues to far outpace supply. Total cloud revenue (apps + infrastructure) rose 27% YoY to $7.2 billion. Within that, cloud infrastructure (IaaS) revenue surged by 55% to $3.3 billion, while cloud database services grew by 32%. Meanwhile, cloud application (SaaS) revenue of $3.8 billion increased 11%. Importantly, multicloud database revenue from Amazon (AMZN), Alphabet (GOOG) (GOOGL), and Microsoft (MSFT) increased by a stunning 1,529%. Notably, total revenue in the quarter jumped 11% YoY to $14.9 billion, while adjusted earnings per share increased 6% to $1.47. Oracle's Balanced Capital Return ProgramOracle is building massive data centers, which led to $8.5 billion in capital expenditures. This is why free cash flow for the quarter was a negative $362 million. However, management stressed the fact that the capital expenditure is for revenue-generating equipment going into data centers, which is why the company views capex as an investment to convert the RPO backlog into future revenue. Oracle forecasts fiscal 2026 capex to be around $35 billion. Despite these continued investments, Oracle returned $5 billion in dividends over the last 12 months and repurchased shares worth $95 million in Q1. Aggressive OCI Revenue TargetsOracle provided a clear multi-year roadmap for Oracle Cloud Infrastructure (OCI). Management now forecasts OCI to increase 77% to $18 billion in fiscal 2026, followed by $32 billion, $73 billion, $114 billion, and $144 billion over the next four years. Management confidently said that much of the OCI revenue growth has already been factored into that RPO number. Not only that, management also stated that the company intends to sign more multibillion-dollar contracts, potentially pushing RPO over half a trillion dollars. No doubt, Oracle’s $455 billion backlog is compelling, but providing capacity, enrolling customers, and converting bookings into recurring income requires flawless execution at scale. If Oracle converts those bookings as management expects, the company's cloud business might become a large-scale revenue generator. Analysts who cover ORCL stock expect its revenue and earnings to increase by 16.9% and 12.6% in fiscal 2026. Revenue and earnings are further expected to grow by 21.6% and 18.8%, respectively, in fiscal 2027. Currently, Oracle is trading at a premium of 45x forward earnings. What Does Wall Street Say About ORCL Stock?Following Q1 earnings, Mizuho Securities, DZ BANK AG, Barclays, and many others maintained their “Buy” rating on the stock. Overall, analysts are bullish about ORCL stock, rating it a “Strong Buy.” Out of the 37 analysts covering the stock, 26 rate it a “Strong Buy,” one says it is a “Moderate Buy,” and 10 rate it a “Hold.” The average target price for Oracle stock is $309.57, representing potential upside of 5% from its current levels. The high price estimate of $410 suggests the stock can rally as much as 39% this year. A vast, visible RPO backlog, a rapidly increasing database and multi-cloud footprint, defined multi-year OCI revenue projections, and a balanced capital return program all contribute to ORCL stock's bullish outlook. Long-term patient investors willing to accept the short-term risk of negative free cash flow in return for a possibly dominant long-term AI platform may find ORCL to be an outstanding buy-and-hold option. However, given that the stock is trading at a premium, risk-averse investors might want to accumulate shares at around $246 to $256 levels.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|