|

|

Kroger Co.'s Quarterly Earnings Preview: What You Need to Know

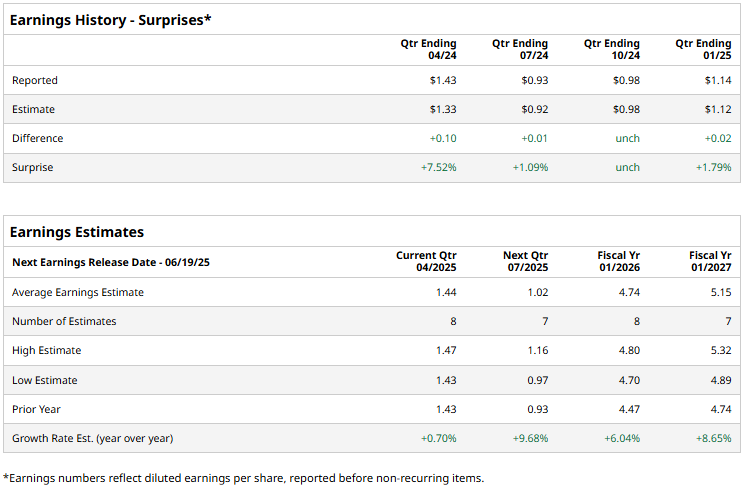

Cincinnati, Ohio-based The Kroger Co. (KR) operates as a food and drug retailer. The company operates combination food and drug stores, multi-department stores, marketplace stores, and price impact warehouses. With a market cap of $46.5 billion, Kroger operates as one of the world's largest food retailers. The grocery giant is expected to release its Q1 earnings on Thursday, Jun. 19. Ahead of the event, analysts expect Kroger to report an adjusted profit of $1.44 per share, marginally up from $1.43 per share reported in the year-ago quarter. On a more positive note, the company has matched or surpassed analysts’ bottom-line estimates in each of the past four quarters. For the full fiscal 2026, analysts expect Kroger to report an adjusted EPS of $4.74, up 6% from $4.47 in fiscal 2025. While in fiscal 2027, its earnings are expected to surge 8.7% year-over-year to $5.15 per share.

KR stock prices surged 28.5% over the past 52 weeks, significantly outpacing the S&P 500 Index’s ($SPX) 8.7% gains and the Consumer Staples Select Sector SPDR Fund’s (XLP) 7.1% returns during the same time frame.

The recent surge in Kroger stock prices can partly be attributed to the flow of funds from discretionary and cyclical stocks to consumer staples, fueled by the increased macro uncertainties. Meanwhile, Kroger’s stock gained 2% after the release of its mixed Q4 results on Mar. 6. The company’s adjusted sales for the quarter increased 2.6% year-over-year to $34.3 billion, which missed the Street’s expectations by a thin margin. Meanwhile, its adjusted EPS remained flat at $1.14, which exceeded the consensus estimates by 1.8%. On a more positive note, Kroger expects its fiscal 2025 identical sales without fuel to increase 2% to 3% and its adjusted EPS to range between $4.60 to $4.80, representing a 5.1% year-over-year growth at the midpoint. The consensus view on KR stock remains optimistic, with a “Moderate Buy” rating overall. Of the 20 analysts covering the stock, opinions include 11 “Strong Buys,” eight “Holds,” and one “Strong Sell.” As of writing, the stock is trading slightly above its mean price target of $67.95. On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|